DIY Home Insurance Inspections: Closing the Gap with Homeowners

A Report by Xceedance

From groceries to travel, consumers have embraced the do-it-yourself mindset. Insurance is no different. Homeowners are increasingly open to using their smartphones to perform home inspections—whether for obtaining new policies or documenting damage for claims. They say they’re ready, willing, and able to take pictures themselves and yet willingness is only half the story.

The survey also reveals a confidence gap: homeowners want to self-document, but many aren’t confident they’ll do it right. This report unpacks what that means for insurers—and how carriers and MGAs can close the gap to unlock faster claims, smoother underwriting, and stronger customer trust.

A Willingness to Self-Inspect

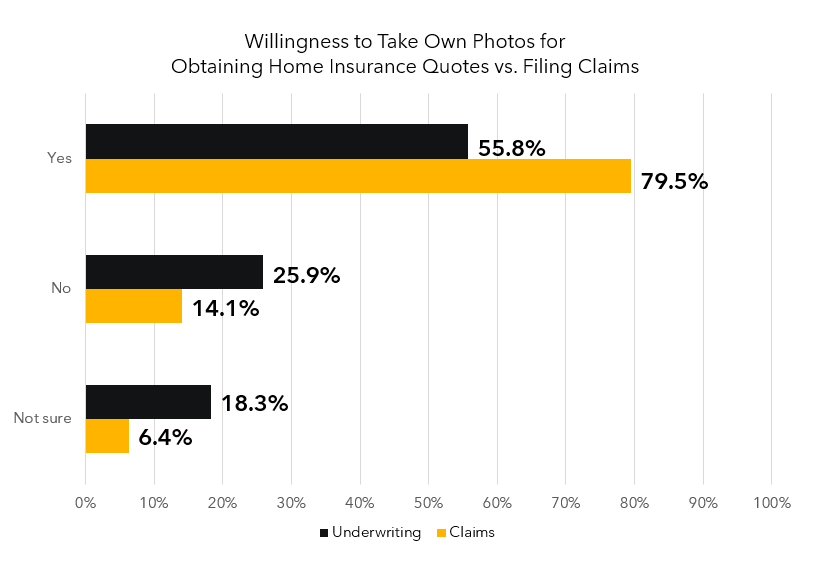

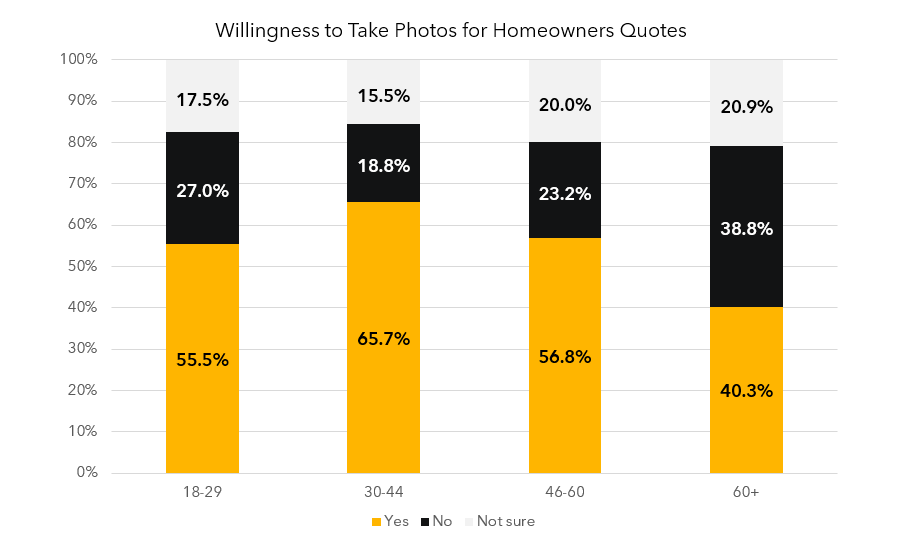

More than half of homeowners (55.8%) say they would take smartphone photos to obtain an insurance quote. That willingness jumps to nearly 80% when it comes to documenting property damage for a claim.

Claims Leads the Way

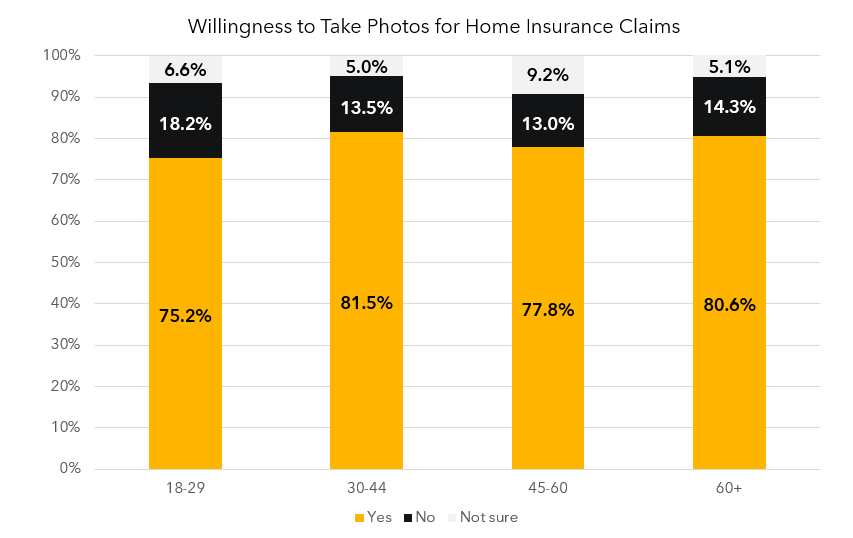

Homeowners know what’s at stake when filing claims: the faster they provide documentation, the faster they can be made whole. Nearly 80% of respondents said they’d use their phones to document damage, demonstrating that claims may serve as the proving ground for DIY insurance inspections.

Once homeowners become comfortable snapping and submitting photos for claims, that familiarity can lower the barrier for other insurance processes—like underwriting for new policies or documenting changes in a home for endorsements.

Older homeowners, often assumed to be more reluctant adopters of digital tools, show the highest willingness to use their smartphones for claims (more than 80% among those 60+). That suggests this isn’t just a generational trend—it’s a situational one. When the stakes are clear and the payoff is fast, people are ready to act.

For insurers, this signals an opportunity: leverage claims to build consumer comfort and confidence with smartphone inspections. Then, translate that trust into smoother underwriting and endorsements—turning a one-time behavior into a lasting, scalable shift in how insurance gets done.

Control is the New Convenience

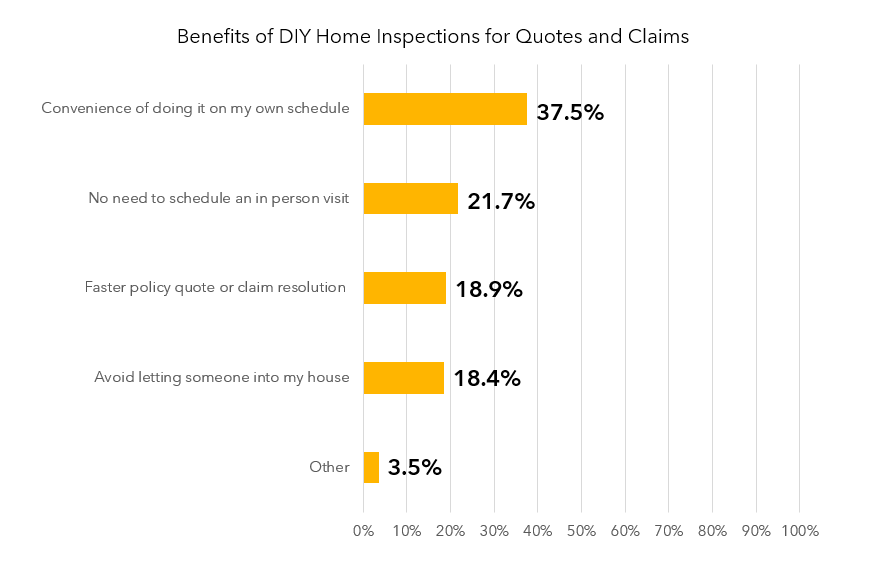

When asked why they’d embrace DIY, homeowners pointed to several benefits:

- Convenience of doing it on my own schedule

- No need to schedule an inspector

- Avoiding letting someone into my home

This isn’t just about speed—it’s about control. DIY puts consumers in charge of the process, on their timetables.

Closing the Confidence Gap

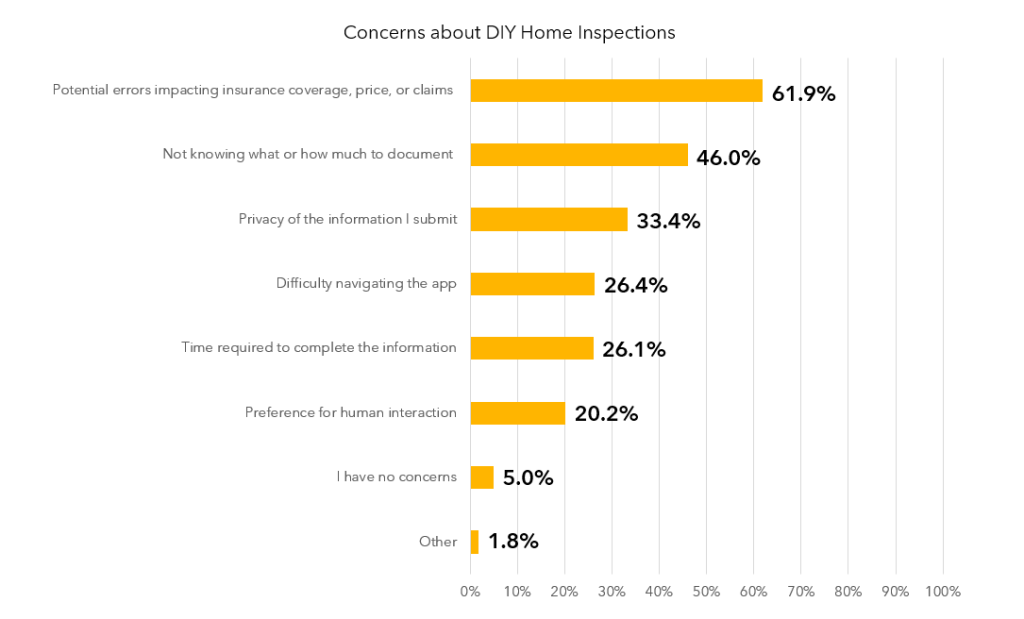

Despite enthusiasm, uncertainty is holding back adoption.

- 61.9% worry about making an error that could affect coverage or claims.

- 46% are unsure what or how much to document.

- Others cite app complexity, time required, and privacy concerns.

There’s a gap — a disconnect between homeowners’ willingness to use their smartphones to document their homes, and the confidence that they’re doing it correctly and not missing anything. This gap has the potential to limit adoption and frustrate users, so it’s important that insurers address it, both in the applications themselves and the support they provide.

The Support Homeowners Expect

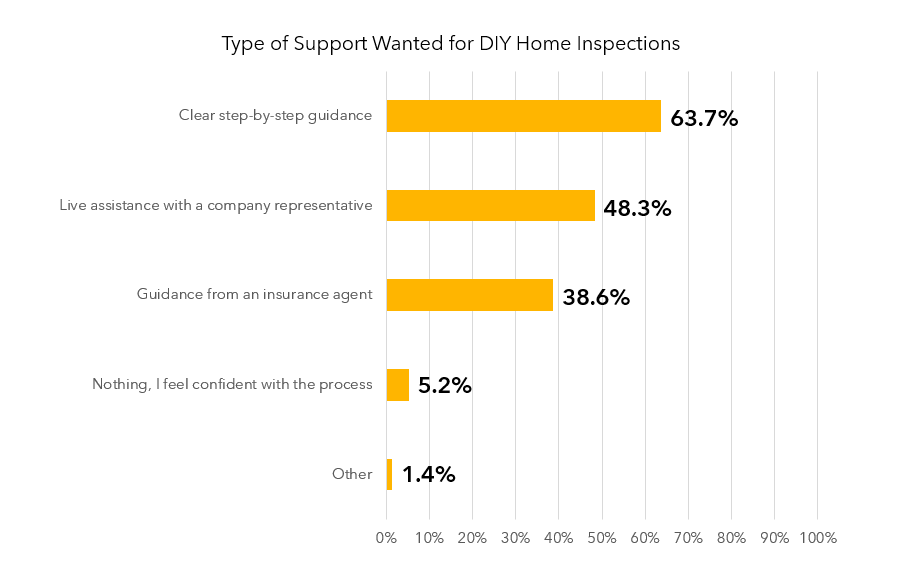

Consumers don’t want to be left alone—they want help in the right ways, including:

- Step-by-step guidance (63.7%)

- Live assistance from a company representative (48.3%)

- Guidance from their agents (38.6%)

There’s clearly a demand for better human support integrated into digital journeys.

Looking Ahead

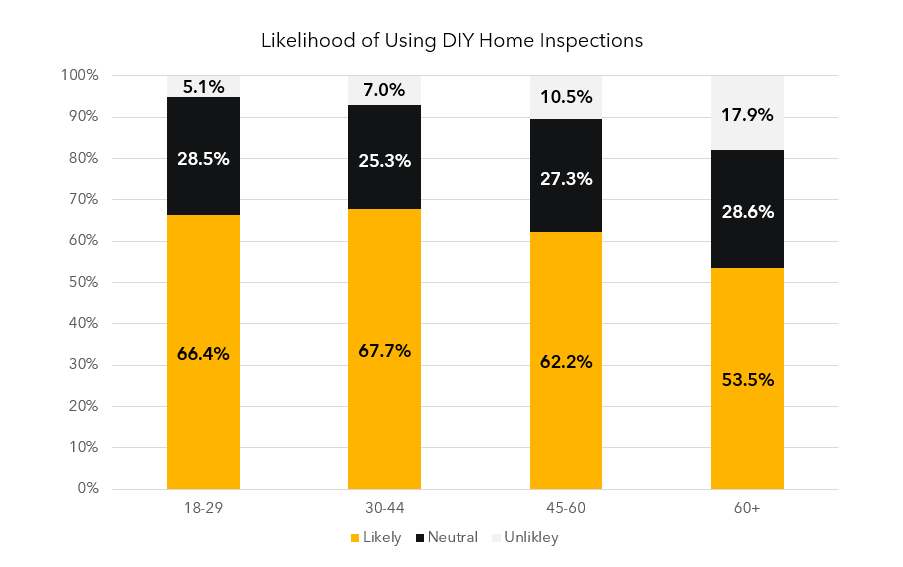

More than six in ten homeowners (62.5%) say they are very or somewhat likely to try smartphone inspections if their insurers offered it. Younger homeowners skew higher toward very likely, but even middle-aged and older groups show strong openness.

Implications for Insurers

DIY inspections are no longer a hypothetical. Consumers are willing—but insurers must bridge the gap. To succeed, carriers should:

- Raise Awareness: Explain what DIY inspections are, how they work, and why they benefit the customer.

- Make It Easy: Build intuitive apps that guide users visually, provide feedback, and reduce errors.

- Blend Human + Digital: Offer optional live support and clear escalation paths.

- Highlight Speed: Emphasize that DIY can get claims paid faster and quotes delivered sooner—benefits that matter most to policyholders.

Smart-phone driven home inspections don’t simply streamline insurer operations—they create a customer experience that’s modern, transparent, and empowering.

DIY insurance inspections represent the next step in consumer-driven service. By delivering guidance, education, and easy-to-use tools, insurers can deliver the speed and convenience today’s homeowners expect. Those that move first will not only save time and money but also win the loyalty of customers who increasingly want to be part of the process.

Survey Methodology

The survey was conducted online nationwide in July 2025 using SurveyMonkey. More than 1,120 U.S. homeowners participated.